42 calculating tax math worksheets

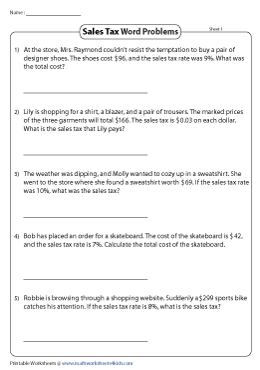

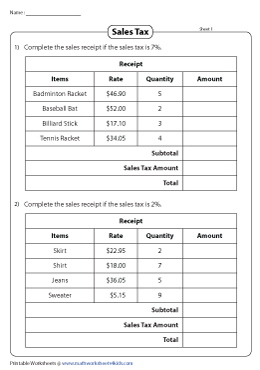

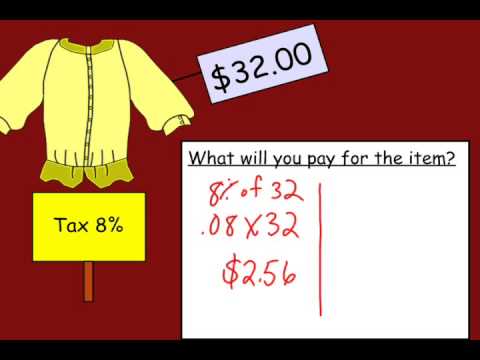

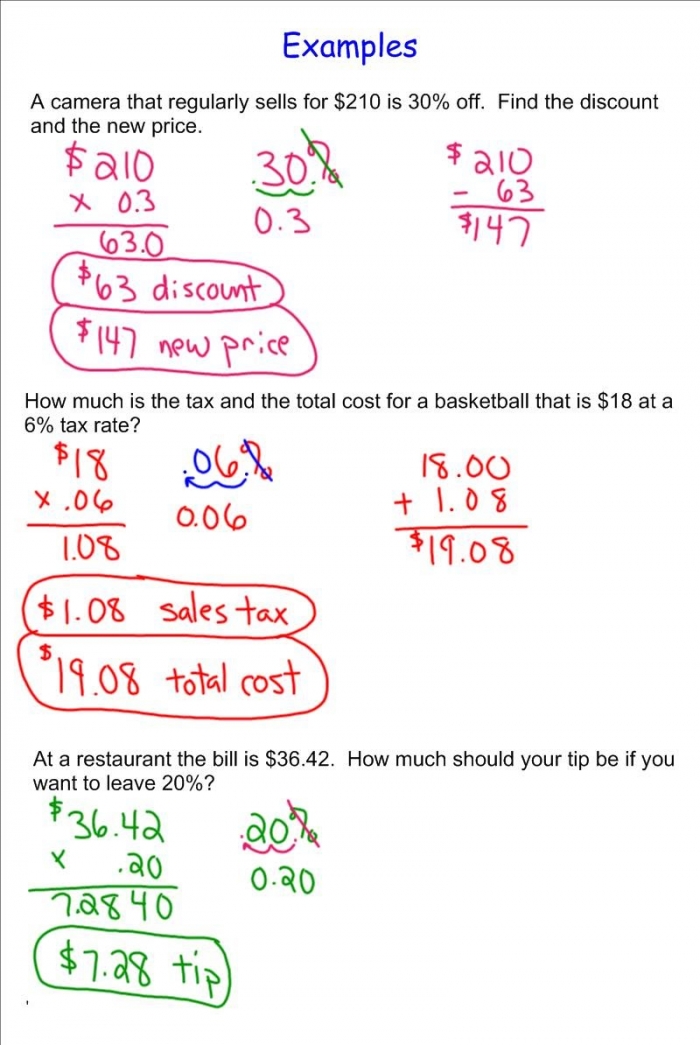

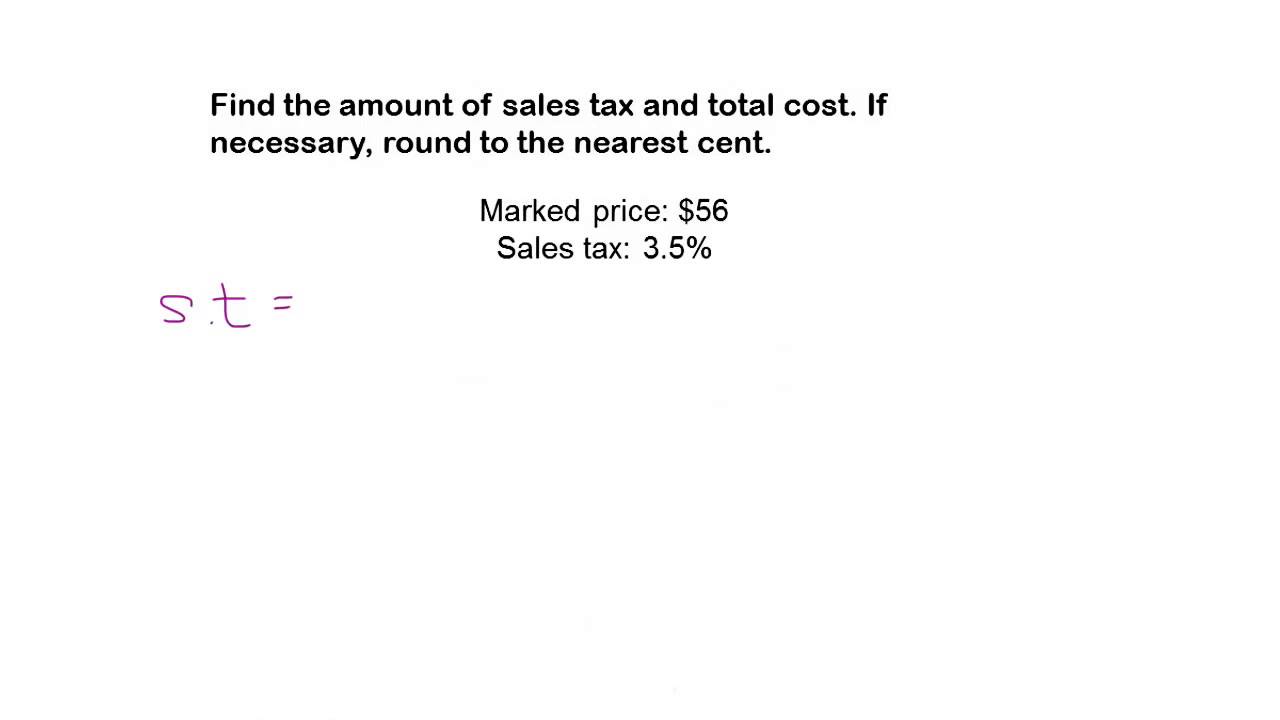

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Worksheet See in a set (11) View answers Add to collection PDF Sales Tax and Discount Worksheet - psd202.org Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25

Calculating tax math worksheets

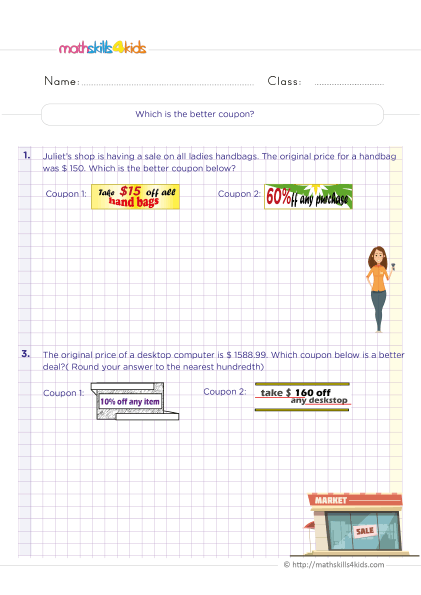

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values. PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! ... The sales tax in Texas is 8.25% and an item costs $400. How much is the tax? $_____ 18) The price of a table at Best Buy is $220. If the sales tax is 6%, what is the final price of the table including tax? $_____ ... Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3 The listed price of a dress is $59.99. If the tax is 8%, what is the total cost?...

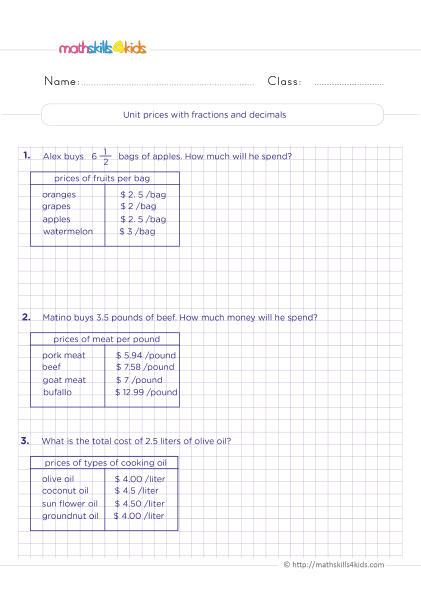

Calculating tax math worksheets. Property Tax Calculations and Prorations Math Worksheet This video takes students through a DETAILED explanation of how to calculate property taxes using T Bar formulas. There are multiple examples and all are wo... calculating tip worksheet 7th Grade Math Discount Worksheets Printable - Note Worksheets And Tips lbartman.com. tax sales worksheet tips discount solving problem grade discounts leveled markups math worksheets 7th printable problems 6th 5th 9th middle. Money Math: Calculate Tips | Worksheet | Education.com | Money Math . money calculating rounding ... Quiz & Worksheet - How to Calculate Property Taxes | Study.com Print Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750... Finding the rate of a tax or commission: Worksheets Welcome to the Finding Percents and Percent Equations Worksheets section at Tutorialspoint.com. On this page, you will find worksheets on finding a percentage of a whole number, finding a percentage of a whole number without a calculator: basic & advanced, applying the percent equation, finding a percentage of a total amount: real-world situations, finding a percentage of a total amount ...

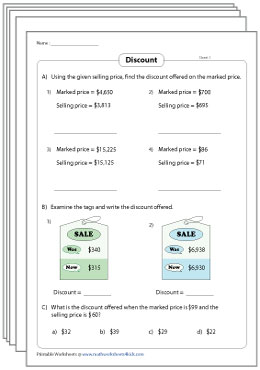

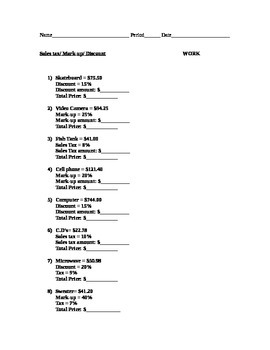

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets. Income Tax worksheet - Liveworksheets.com Income Tax Calculating income tax and money received after deductions. ID: 1342388 Language: English School subject: Math Grade/level: Secondary ... More Math interactive worksheets. Matching Number Name to Numbers (1-10) by khosang: Mixed Times Table by QKidz: Addition DJ by CPSGradeOne: Shapes: matching name by sheb1207: Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ... Markup, discount, and tax - Math Worksheet x 155 = 12 100 Now, cross multiply. x ∙ 100 = 12 ∙ 155 100 x = 1860 x = 18.6 18.6 is 12% of 155. Example 2: Let's try another. 9 is what percent of 215? 9 will be our "IS", 215 is our "OF" and we are looking for our percent. 9 215 = x 100 9 ∙ 100 = x ∙ 215 900 = 215 x x = 4.19 Now let's apply this to shopping and figuring out discounts and taxes.

PDF WORKSHEET General 2 Mathematics - JSCHS MATHEMATICS HELP SITE WORKSHEET General 2 Mathematics Topic Areas: Financial Mathematics FM3 - Taxation Teacher: PETER HARGRAVES Source: HSC exam questions ... Write an equation that could be used to calculate the tax payable, , in terms of the taxable income, , for taxable incomes between and . (2 marks) 4. Algebra, 2UG 2010 HSC 27c ... Calculating Tax Worksheet Teaching Resources | Teachers Pay Teachers This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on… calculating commission worksheet math worksheets calculating sales tax - consumer math worksheetstaxes. 9 pictures about math worksheets calculating sales tax - consumer math worksheetstaxes : calculating tax tip and commission practice worksheet - tax walls, percent discount, taxes and tips coloring worksheet | color worksheets and also insurance agent commission split … How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems. Discount \ (=\) Multiply the regular price by the rate of discount. Selling price \ (=\) original price \ (-\) discount. Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price.

PDF Math Tax Worksheet - christianperspective.net Math Tax Worksheet This worksheet is designed to give you a simplified look at filling out a 1040 U.S. Individual Income Tax Return. ... E. Calculate your Adjusted Gross Income—how much you made after the allowable deductions—by subtracting what you wrote on line 36 (the deductions) from what you wrote on line 22 (the total ...

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

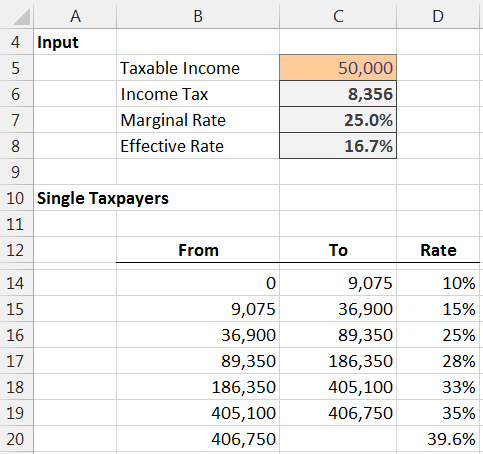

PDF Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with ... - TD Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with answers (Teacher Copy) Federal Tax Brackets and Rates in 2011 for Single Persons From: To: Taxed at Marginal Rate of: $0 $8,500 10% $8,501 $34,500 15% $34,501 $83,600 25% ... Gr9-12 Taxes Worksheet TEACHER VERSION.docx

calculating tax worksheet Self-Employed 401k Contribution Worksheet Free Download. 8 Images about Self-Employed 401k Contribution Worksheet Free Download : Calculating Tax Tip And Commission Practice Worksheet Answers - Tax Walls, Markup, Discount, and Tax (Harder) Worksheet for 8th - 9th Grade and also Self-Employed 401k Contribution Worksheet Free Download.

Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Answer: The sales tax is $1949.35 and the total cost is $29,990.00 + $1949.35 = $31,939.35. As you can see, for small purchases, sales tax can be a nuisance; whereas for large purchases, sales tax can be a significant amount. Let's look at an example in which the sales tax rate is unknown.

Calculating Sales Tax Ontario Teaching Resources | TpT This resource will allow you to teach your students about sales tax in Ontario, how to calculate it, and then will allow them to practice this new knowledge through a fun worksheet activity!This resource also meets various expectations w. Subjects: Decimals, Math, Numbers. Grades: 7th - 10th. Types:

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes

tax calculation worksheet Coaching Our Kids With Aspergers: Math Worksheet - Calculating Tax aspiecoach.blogspot.com. calculating worksheet tax worksheets math taxes answers coaching aspergers. Corporate Tax Calculator Template | Excel Templates . tax corporate calculator templates template excel income company calculate sample pay examples open ...

PDF Lesson 3 v2 - TreasuryDirect tax. 6. calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi-step problems Personal Finance Concepts income, saving, taxes, gross income, net income ...

calculating tax worksheet commission worksheet sales commissions calculations quiz study stair structure step calculate explain answer. Tax, Simple Interest, Markups, And Mark Downs . math worksheet interest simple grade tax worksheets problems word 7th sales downs mark markups met purchase standard. Profit And Loss Worksheet briefencounters.ca

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet ... In our example case, the subtraction amount listed is $8,420. The IRS calculated this from the start of the bracket times the rate of the bracket minus the amount of tax actually owed by moving through the lower brackets or in this case $80,250 * 0.22 - $9,234.9 = $8,420.10. So $33,000 minus $8,420 = $24,580 for your tax owed.

Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3 The listed price of a dress is $59.99. If the tax is 8%, what is the total cost?...

PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! ... The sales tax in Texas is 8.25% and an item costs $400. How much is the tax? $_____ 18) The price of a table at Best Buy is $220. If the sales tax is 6%, what is the final price of the table including tax? $_____ ...

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

:max_bytes(150000):strip_icc()/menu1-56a602543df78cf7728adf15.jpg)

:max_bytes(150000):strip_icc()/Christmas-Shopping-Worksheet-1-56a602eb3df78cf7728ae5a1.jpg)

0 Response to "42 calculating tax math worksheets"

Post a Comment